1111

The Flood / Cheat, what is this fucking wizardry?

« on: January 26, 2015, 02:35:42 PM »

Speak, pheasant!

|

This section allows you to view all posts made by this member. Note that you can only see posts made in areas you currently have access to. 1111

The Flood / Cheat, what is this fucking wizardry?« on: January 26, 2015, 02:35:42 PM » Speak, pheasant! 1112

Serious / Socialists take control of Greece« on: January 26, 2015, 02:14:05 PM »

BBC

Quote The head of Greece's far-left Syriza party, Alexis Tsipras, has been sworn in as prime minister and is set to lead an anti-austerity coalition government. Well, this will probably end horribly. 1113

The Flood / Self-entitled parents« on: January 25, 2015, 01:54:29 PM »

I've gotten a lot of flack for not thinking very highly about my parents, but I literally just heard my mother from the kitchen saying: "I deserve a medal for being a fucking unrecognised Mother Theresa". It's fucking ridiculous.

ITT: discuss annoying parents. 1114

The Flood / at a party« on: January 24, 2015, 05:04:35 PM »

Just at a friends after going to the pub

Anyone esle doing anything interesting? 1115

Serious / These are my notes for that possible youtube video« on: January 24, 2015, 10:26:37 AM »

It's sort of a quasi-script to guide me as I talk; since I want it to be accessible, I'd be grateful if some of you guys were to read some of it over and let me know if it needs rephrasing or altering in order to make it more understandable. I'll underline the most important bits.

Quote First and foremost I just want to offer a disclaimer regarding Stefan himself. I have a great deal of respect for Stefan in the way he collates and presents information, even if I don't agree with his conclusions. It's fairly obvious that he has an appreciation of empirical evidence, so if he ever watches this video I hope he's able to appreciate the information I'm going to put forward and try to reconcile it with his own conclusions—even if he disagrees with me in the end. I also consider myself sympathetic to 'free banking' (that is, the abolition of the central bank), especially the work of George Selgin, but still find fault with Stefan's analysis. 1116

Serious / Thinking about doing a Youtube video« on: January 23, 2015, 05:35:24 PM »YouTube Rebutting this video about the economy and the causes of the Great Recession. Anybody think it's a good idea, or worth pursuing? 1117

Serious / Can animals have rights?« on: January 23, 2015, 02:21:28 PM »

I've been struggling with the idea that animals have rights. It seems to me that having rights implies obligations (you're obligated to not murder your neighbour), but how can we grant rights to the likes of those who lack the cognitive ability to even conceive of such concepts in the first place?

Do rights imply obligations? 1118

Serious / I've changed my mind, rights do exist (they come from morality)« on: January 23, 2015, 02:12:03 PM »

I used to be of the opinion that 'rights' don't exist in any real, or objective, sense. I've changed my mind. I think rights necessarily stem from morality, and since morality is objective then (some) rights are necessarily objective, also.

It seems that the individuals of a society are to be endowed with all the negative rights reasonable to foster self-reliance and a sense of regularity. Certain positive rights also necessarily exist, in the name of morality. Actually, the more I think about it, the more the line between rights and morality becomes blurry. It seems that rights are essentially just politco-legal manifestations of morality. It might not be true to say, in that case, that rights themselves are objective, but that rights have an objective basis. I don't know, I need to think about it. 1119

Serious / California rapper faces 25 years to life for his lyrics« on: January 23, 2015, 12:05:38 PM »

CNN

Quote (CNN)Song lyrics that glorify violence are hardly uncommon. But a prosecutor in California says one rapper's violent lyrics go beyond creative license to conspiracy. Yeah, and my country is the one assaulting freedom of speech. 1120

Serious / Most controversial public figures whom you admire?« on: January 22, 2015, 01:44:21 PM »

They don't necessarily have to be explicitly political, but any controversial public figure will probably have had some sort of impact on the political landscape.

For me: - Alan Greenspan. - Gerald Ford. - Helmut Kohl. - Lawrence Krauss. - Michael Shermer. - Sam Harris. - Christopher Hitchens. - Friedrich Nietzsche. - Ludwig Erhard. 1121

Serious / ISIS suffered its heaviest ever defeats today in Iraq« on: January 22, 2015, 01:09:54 PM »

Yahoo.

Quote Over the last 24 hours, ISIS has been defeated in every front in Iraq in unprecedented way. From Mosul to the north to Anbar to the west and Diyala to the east, Iraqi government forces, Shiite militias, Sunni tribes and Kurdish forces were all victorious in battle. That's it lads, smash the cunts. In other news, ISIS is probably executing its own fighters. 1122

The Flood / Woo, a bunch of new avatars!« on: January 22, 2015, 07:38:34 AM »

- Alan Greenspan.

- Ben Bernanke. - Mark Carney. - Christopher Hitchens. - Sam Harris. - Michael Shermer. - Lawrence Krauss. - Helmut Kohl. - Gerald Ford. Spoiler Fucking party time! ITT: Who has the best avatar(s) on the site? Spoiler Apart from me, of course 1123

Serious / If you were put in charge, what economic reforms would you make?« on: January 22, 2015, 07:14:10 AM »

And no dodging responsibility, either; no delegations.

Spoiler Don't worry, I won't bite. Spoiler lol jk Spoiler I'm going to rip the shit out of you. 1124

Serious / Liberals are probably more close-minded that Conservatives« on: January 22, 2015, 02:55:48 AM »

Just found this on the AEI website and it talks about Jonathan Haidt's (who, bearing in mind, used to be a partisan Liberal) book The Righteous Mind which, by the way, I can't recommend highly enough.

Quote To be “close-minded” is, according to the dictionary, to be “intolerant of the beliefs and opinions of others; stubbornly unreceptive to new ideas.” To be conservative and close-minded, according to popular portrayal, is a redundancy—a package deal that liberals can and do take for granted. 1125

The Flood / Old people playing GTA« on: January 21, 2015, 04:17:18 PM »YouTube Oh God, I'm fucking dead. I lost it around 5.50. ITT: Discuss how old people are secretly all psychopaths. 1126

The Flood / Should I skip college tomorrow?« on: January 21, 2015, 04:08:14 PM »

I have two lessons, politics and history. In politics we won't be doing anything that I can't find out about and learn from the text-book, and in history I'll miss out on some information regarding various aspects of Nikita Khrushchev's leadership of the Soviet Union, which'll be more difficult to catch up on. I feel I'll be more productive at home, though, instead of spending three hours doing nothing at college for my free periods.

So, fuck it, your call. 1127

Serious / Would Negroes be better off if slavery had never existed?« on: January 21, 2015, 12:30:40 PM »

I'd have to say no.

The problem, of course, is confusing 'They're better off because of slavery' with 'We never should've ended slavery'. Only the first proposition seems to be true. 1128

Serious / U.K. government most transparent in the world, followed by the U.S. and Sweden« on: January 21, 2015, 12:21:13 PM »

BBC

Quote The UK government is the most open and transparent in the world, according to global rankings looking at public access to official data. Well fuck, credit where credit is due. 1129

Serious / Union of Muslim Scholars pushes U.N. to make contempt of religion illegal« on: January 21, 2015, 11:41:03 AM »

sigh

Quote DOHA, Jan 21 — A leading Islamic organisation has called on the United Nations to make “contempt of religions” illegal and urged the West to protect Muslim communities following the attack on French magazine Charlie Hebdo. When will we realise that even the moderates are often intolerable? 1130

The Flood / The amount of stars in the Andromeda galaxy is mind-blowing (picture)« on: January 21, 2015, 10:50:37 AM »

Zoomable image; each point of light is a star.

Looks like we'll be revising up our estimate of one trillion stars. 1131

Serious / The financial crisis wasn't important, here's why (with a tl;dr)« on: January 21, 2015, 10:38:28 AM »

This is an understandable trope in a lot of people's minds (even professional economists), but I think when the evidence is considered there's little support for such an idea.

I'd just like to say that, yes, predatory lending was a thing. Yes, Dick Fuld was a reckless man for leveraging Lehman Brothers to the extent that he did. Yes, we would've had a sub-prime mortgage crisis anyway. So, estimates for the beginning of the financial crisis have varied. Some people place it as the failure of Lehman Brothers in late 2008, whereas some place it with the discontinuation of three of BNP Paribas's hedge funds. I prefer the second definition, since--as I will demonstrate--disintermediation as caused by a reduction in banking activity isn't that important and using the actions of BNP Paribas leaves a very uneventful year-long gap in which nothing significant seems to happen. As for the Recession, we know it began in December of 2007, but was exceptionally mild for the first six-or-so months. Lee E. Ohanian points out that the Depression couldn't have been caused by the 'financial crisis of 1929', because there really wasn't a financial crisis in 1929. The 40pc declination of banks between 1929 and 1933 was because of un-diversification (because of size) and mergers. Indeed, the biggest year of bank failures was 1933--which was the beginning of the recovery, why? Because expansionary monetary policy revived aggregate demand. AD is key here. Any disintermediation between banks can be largely weathered provided a stable growth of nominal income, which can be supplied by monetary policy. Ohanian goes on to note, regarding the 2008 Recession, that intermediation between banks didn't decline as much as you should expect if you believe the credit cycle primarily drives the business cycle. Bank credit relative to nominal income was at an all-time high by the end of 2008. And it's only really until nominal income tanks in mid-2008 that the economy goes into a tailspin. The S&P 500 index (as well as house prices) demonstrate* that the economy only entered this tailspin when they had already lost over half their value. While, at the same time, household liabilities** only declined with the drop in nominal income. The same is true for rising unemployment***: Spoiler *  **  ***  It makes sense in light of the financial crisis, too. Falling nominal income means less money, and would obviously cause or exacerbate any debt problems. I'll end it here, lest I bore you all to death. Also, these graphs here show the relationship between nominal income and rGDP following recessions supposedly induced by financial crises. One through three, four and five. In other words, so long as the central bank maintains a stable level of nominal income growth (aggregate demand), then the producers will supply the output assuming no exceptional supply-side issues. Financial crises, really, are a non-starter when it comes to discussing downturns. I've put this in the Bonfire specifically because this is very contentious (at least among economically minded people) and I'm not even sure about my own stance on the issue, so I can't consider it an authoritative guide in any way. TL;DR >financial problems don't matter so long as the government maintains spending in the economy 1132

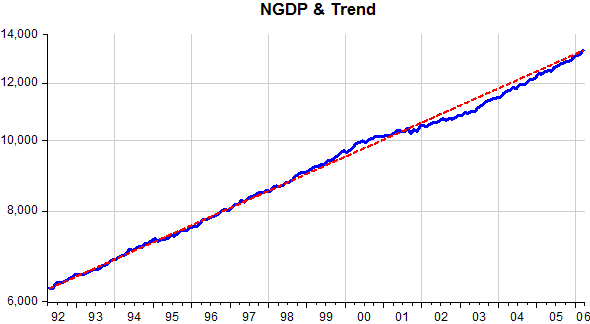

Serious / Explaining the Great Moderation (with a very simple tl;dr)« on: January 20, 2015, 12:15:37 PM »

The Great Moderation was a decrease in macroeconomic volatility. Essentially, the business cycle just calmed down for a while, represented here:

Spoiler  If there are just three things you need to understand while studying economics, they're the Great Depression, the Great Moderation and the Great Recession. With, I think, the Great Moderation being the most important. How exactly did this decrease in business cycle fluctuations come about? Good monetary policy, is the answer. A speech by Ben Bernanke (most recent Chair of the Fed) tells us that nominal income--as well as possibly inflation--is the only reliable indicator of monetary policy within an economy. Not interest rates, not commodity prices and not monetary aggregates. If we take this to be the case, how did monetary policy perform during the Great Moderation? Very well, indeed. Spoiler  Alan Greenspan--Chair of the Fed at the time--has given conflicting views about whether or not they were targeting nominal income at the time. However, in a late 1992 FOMC meeting, Greenspan states: Quote I'm basically arguing that we are really in a sense using [unintelligible] a nominal GDP goal of which the money supply relationships are technical mechanisms to achieve that.And this is supported by a study from Josh Hendrickson. There has been some push-back against the monetarist line, especially by those who take a credit cycle-view of the economy. It goes back to a 1983 paper by Ben Bernanke, in which he argues that disintermediation between banks (otherwise known as a credit crunch, or debt-deflation) is a sort of 'real' shock which can make the economy worse by depressing aggregate demand. This idea, however, doesn't hold up under scrutiny. There's no reason why financial crashes should drive the entire economy into a Recession, and indeed we've often seen that they don't, they just exacerbate already bad monetary policy--as in 2008. In 1987, just after Greenspan became chairman, the biggest crash in stock prices occurred. It was bigger than the 1929 stock market crash; in fact, it was so bad that 33 economists promulgated the view that the following years could be as bad as the 1930s. It wasn't. . . Pretty much nothing happened in the real economy, because the Fed injected liquidity and maintained aggregate demand. These two graphs show what happened to nominal spending growth (aggregate demand) in 1987 and 2008. Spoiler  And, in support of this view, a paper by the Bank of England concluded that quantitative easing works not because it facilitates lending, but because it maintains aggregate demand. TL;DR: - Good monetary policy = good economy. - Alan Greenspan is forgetful, but a monetary god. 1133

Serious / Why the Gold Standard is a shit-tier idea« on: January 19, 2015, 12:05:22 PM »

There's been something of a resurgence of goldbugs since the failed primaries of Ron Paul and the rise of the Tea Party. Of course, this idea has always existed, especially in America, but the Gold Standard really is a poor--and potentially damaging notion--in terms of economic impact.

A 2012 poll showed none of the polled economists supported the idea that a return to a gold standard would result in better "price-stability and employment outcomes". In my own opinion, and that of several similarly-minded economists, the biggest problem with this is the removal of monetary authority from the government. It takes away a government's ability to fight recessions via monetary policy, and gives it to our balance of trade, gold reserves and gold mines. In terms of advantages, one of the big ones offered to us is price stability. While removing authority over the money supply might reduce our ability to fight recessions, it makes serious swings in inflation improbable and helps induce economic stability by smoothing out the value of the currency. While it's true that long-term price stability is a virtue of the gold standard, and that significant--or even hyper--inflation are rare, it just isn't true that the gold standard induces stability in any meaningful way. Inflation under the GS  Inflation under QE  As Milton Friedman noted: inflation is, always and everywhere, a monetary phenomenon. There has never been a fiat money system, under which, the central bank has not had the power to control inflation. In addition to this, as Ben Bernanke noted, there has never been a fiat money system, under which, the central bank has not been able to control deflation. So, yeah, if you're in favour of a gold standard. . . stop it. tl;dr--gold standard doesn't actually stop inflation 1134

Lo and behold, thine cunts!

Cheat, the alpha cunt--the first of cuntkind, who sits at the throne. Nuka, the beta cunt--the second of cuntkind, with a will as strong as stone. And of course, Kinder, the gamma cunt--third-rate, and truly lowly. Slash, the delta cunt--a lone wolf, independent and with utter focus. And then Dustin, the epsilon cunt--the centre of our community, the genetic locus. -snip- Turkey, the lambda cunt--truly radioactive, in a sense, his half-life confirmed. Rocket, the upsilon cunt--transcendent and immaterial, brilliantly holy. Mr Psy, the tau cunt--forsaking the imperium, to fight on the xeno fronts. And then I? I am the omega cunt--the cunt to end all cunts. 1135

The Flood / Best cover of Midnight City ever« on: January 18, 2015, 04:48:42 PM »YouTube Lyrical genius. 1136

Serious / Does the soul exist?« on: January 18, 2015, 03:39:54 PM »

When it comes to philosophy, I'm quite vehemently opposed to the idea of the soul, or some transcendent 'mind'.

1137

The Flood / Meta's a cunt« on: January 18, 2015, 03:08:15 PM »

hurr durr bandwagon

FUCK ALL Y'ALL 1138

The Flood / Anybody interested in cosmology« on: January 18, 2015, 03:04:45 PM »YouTube Love a bit of Lawrence Krauss. 1139

Serious / So, about Jesus« on: January 18, 2015, 01:36:17 PM »

The idea of the Messiah was one of military kingship, who'd command respect from Jews and gentiles alike. Considering this, it doesn't seem altogether unreasonable that the apostles were--essentially--Iron Age, Palestinian revolutionaries. Wouldn't it be more probably that such a group of people would turn their Messiah into a deity, rather than actually seeing him raise from the dead.

1140

Serious / The housing bubble really was irrelevant« on: January 17, 2015, 01:53:55 PM »

I'll put a tl;dr at bottom

I've often made a point of differentiating the causality of the financial crisis and the Great Recession, but there's another aspect of the recent downturn that I haven't really dealt with. The housing bubble--that is, the rapid decline in appreciating house prices which occurred (in the U.S.) in 2006. Often, the argument goes that the Federal Reserve kept interest rates in the economy too low for too long, and promoted a climate of risk-taking an over-activity in the economy. It makes intuitive sense--low interest rates bring new players into the market who then begin constructing houses in order to meet a temporary increase in demand. Eventually, a rise in interest rates or a sharp decrease in lending will pop the bubble. There's not really any evidence to suggest over-ambitious house-building projects in the 1990s-2005. Housing construction appears to be cyclical on a graph, but this was broken during the aforementioned period and saw a continuous increase in new construction projects for fifteen years. Now, this would be suspect, were it not in line with population growth: Graphs   As for prices themselves? The activity differs so much across the states that it's difficult to say. The grey area on the graph is when the interest rate was supposedly held too low by the Fed from 2002 to 2004: Spoiler  On top of this, the Case-Shiller Index for house prices quite clearly shows a run-up in prices beginning in the late 1990s, which didn't pick up during the period of low interest rates: Spoiler  The problem, too, with using interest rates as a view for monetary policy is that it isn't reliable. It's true that the federal funds rate (the rate that the central bank directly controls) was very low between 2002-2004, but as we can see in the graph below, nominal income was recovering from something of a shortfall. Monetary policy over that two-year period was, essentially, exactly correct: Spoiler  The problem was long-term real interest rates. As we can see in the graphs below, rates on ten-year treasury bonds closely followed the fed funds rate, however this changed after 1990 and the two rates essentially 'unhinged': Spoiler   There are a number of explanations for this, including the one I find somewhat convincing--Bernanke's Global Savings Glut hypothesis. This has garnered support from Alan Greenspan who agrees that the rise in housing prices was probably caused by a decline in long-term rates which the central bank had no control over. And, indeed, looking at several other countries we can see that rising house prices was an almost global phenomenon. House prices were a little different in America, in that they peaked two years before the global downturn, but when you look at the data then it's clear global house prices plunged in 2008-2009 when worldwide nominal income bit the bullet. But what really matters about all this is that it doesn't matter. The housing bubble, at least in 2006 and in the U.S., really is immaterial to the whole discussion. Following the--roughly--50pc decline in house prices come 2006, unemployment didn't shift. It wasn't until mid-2008 to mid-2009 that unemployment really picked up. . . right as global nominal income tanked, and just before the financial crisis. The idea that the housing bust made investors skittish is probably correct, but still immaterial. BNP Paribas seized up some of its activity prior to the Recession in Dec. 2007, about a year before Lehman Brothers failed, but history has shown us that credit crunches don't matter. TL;DR: Spoiler >people blame low interest rates for the housing boom >the idea of a housing boom isn't even a solid one >interest rates were decoupled in the 1990s, the fed couldn't do anything about it >global house prices faced a similar run-up, it was a global phenomenon >global house prices fell when nominal income fell >poor nominal income is a sign of poor monetary policy >we need to focus on central bankers' responsibility with the recession, not the fall in housing prices |